Today, automation tools are necessary for mortgage brokers to succeed. Since getting leads is more of an art than a science, mortgage brokers burn out quickly because of the time-consuming work.

Other than cold calling, flyer drops, knocking on doors of potential leads, and relying on every referral, there is now an easy way of obtaining leads and getting them automated.

Here are the only 3 mortgage automation tools mortgage brokers need to dominate in 2022.

Mortgage Automation Tool #1 Social Media

Social Media is an important tool for your business. In terms of mortgages, the majority of your target market is on Facebook, Instagram, and other social media platforms.

This is why understanding the social media platform that your business will use is important if you want to stand out among your competitors, and attract your target market’s attention.

For example, Facebook is one of the most popular social media platforms, and top marketers know the real power of Facebook advertising to get more leads. Marketers don’t just stick to creating a post and boosting it within the page. They never boost from the page, instead, they use Facebook’s Ads Manager that can be found on Facebook’s Business Manager.

Using this tool will give you the opportunity to optimize your advertising campaign for a variety of goals: from awareness, engagement, and creating conversions from your leads. Before you start optimizing, you should carefully think of your strategy, because if your chosen strategy won’t work, you will just end up wasting your money on the ads. In fact, Facebook advertisements aren't completely automated, but if done right, they can help you generate leads automatically!

Get Our Modern Broker Method System

A plug-and-play marketing package for mortgage brokers. These are proven and tested marketing methods that are specifically tailored to your services.

Mortgage Automation Tool #2 Zapier

Automation tools make your life easier as a mortgage broker and help your business to run more smoothly than the traditional method of acquiring leads.

Zapier is one of the automation tools used by mortgage brokers to link multiple software applications they are already using like Facebook, Instagram, WordPress, Google Suite, Microsoft Apps, and other productivity tools.

In practical terms, one of the automation we built for our partner mortgage brokers is the opportunity to capture and nurture their leads.

For those mortgage brokers looking for an automation tool to automate more of their lead generations and create follow-ups, then using Konnected CRM as a mortgage automation tool is a must.

Mortgage brokers who use Konnected CRM as their automation tool and part of their marketing strategy are saving hours every month, closing more leads, and enjoying the platform. See our results or case studies for our mortgage partners.

The mortgage broker industry is continuously changing, and those mortgage brokers who want to build their business must keep up with digital changes. Konnected CRM and other mortgage automation systems ensure that your business is completely engaged, internally and externally active across all platforms, and you are quickly following with relevant content.

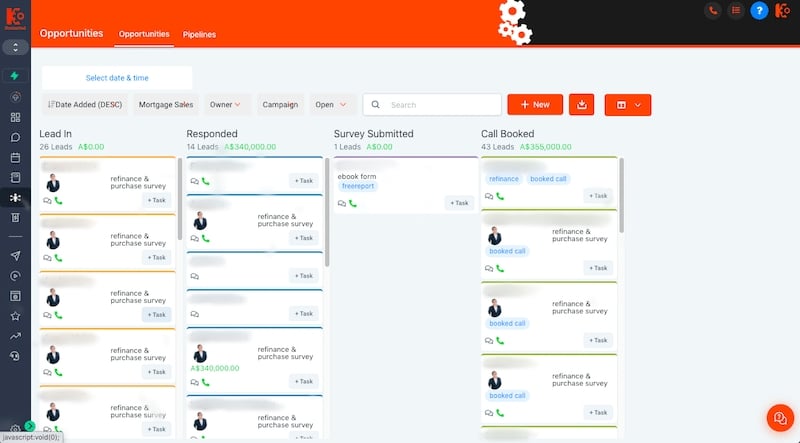

Mortgage Automation Tool #3 Konnected CRM

Mortgage Brokers who want to capture and nurture their leads for the long term, need to have an automation CRM software like Konnected CRM to run their business online efficiently.

People rarely sign a request immediately after filling out a lead capture form, they usually require further information to know how you can help them. As a mortgage broker, it’s your responsibility to help them be familiar with your service. However, reaching out to all of your potential leads all by yourself is an exhausting task.

This is why automation tools like Konnected CRM were created to help you. It helps you to safely store your leads database from lead generation to listing appointments and closing a deal.

Konnected CRM is an automation software tool that helps you get connected to your leads across several channels and manage them all in one place, making your work easier. Channels include – Facebook, Google, Text, Email, and Chat Widget. Konnected comes with all of the essential tools you'll need to nurture your leads and close sales. You can simply receive, respond, and send messages to your leads, even on autopilot.

Book a demo now and get a 14-day FREE trial.

Conclusion:

In the competitive mortgage market today, mortgage brokers must effectively market their services, build a strong brand, and generate high-quality leads. This means investing in automation software that will help you manage your business more effectively and get the most out of every potential lead that you have.