This is a case study of how Down to Earth Finance recently submitted almost $6 million in loan applications using our mortgage marketing system in less than 1 month. They also have a qualified pipeline of over $2 million ready to convert next month.

In this case study, we'll explore how Down to Earth Finance was able to get a 25X return on its social media marketing investment.

The Case

Colin Hingston, principal mortgage broker of Down to Earth Finance, has been a client partner with Konnect Marketing for over 3 years. He has been using the Modern Broker Method for more than 2 years now and has generated great results from it. But over 6 months ago, his Facebook business account was permanently shut down, and he couldn't run ads on Facebook and Instagram.

For the last 6 months, he had tried other solutions to get back to Facebook advertising, but it still did not work for Colin. He tried to hire other agencies and spent over $8000 in lead generation and retainer fees but did not get any return on his investment and submitted 0 loans.

He felt frustrated and almost gave up on his online marketing. For the last 3 years, Colin has been building his brokerage to focus on self-generated online leads. He was nervous as he thought his marketing days using Facebook ads were over.

His frustration was hitting critical mass, and he reached out again around 7 weeks ago.

Colin has had great results with leads since he became a modern broker three years ago. He knows it's the only system that has worked well for him. It's the only way to get the cheapest leads on the market, plus he controls his data, campaign, and budgets.

He doesn't need to sign contracts with agencies or pay for expensive leads. The modern broker method allows Colin to get his leads for wholesale prices. He needed to get this working again.

So to get back on track, he contacted us again to ask for help. We reviewed his situation and came up with some new solutions.

Getting Back On Track

If you have ever worked with Facebook previously, it can be tricky, but that is a story for another time.

We got Colin back to advertising on Facebook and Instagram. After Colin's approval and a couple of weeks, Down To Earth Finance was back advertising again.

And the flood gates opened for Colin. He worked, qualified, and converted.

So about a month ago, we reactivated his Modern Broker Method system again.

Everything is tracked, so when someone clicks the ad, they would be redirected to a website where they submit their information.

Note: We can't show you how we generate the leads here due to IP. But if you would like a demonstration of how it works, click here to book a demo.

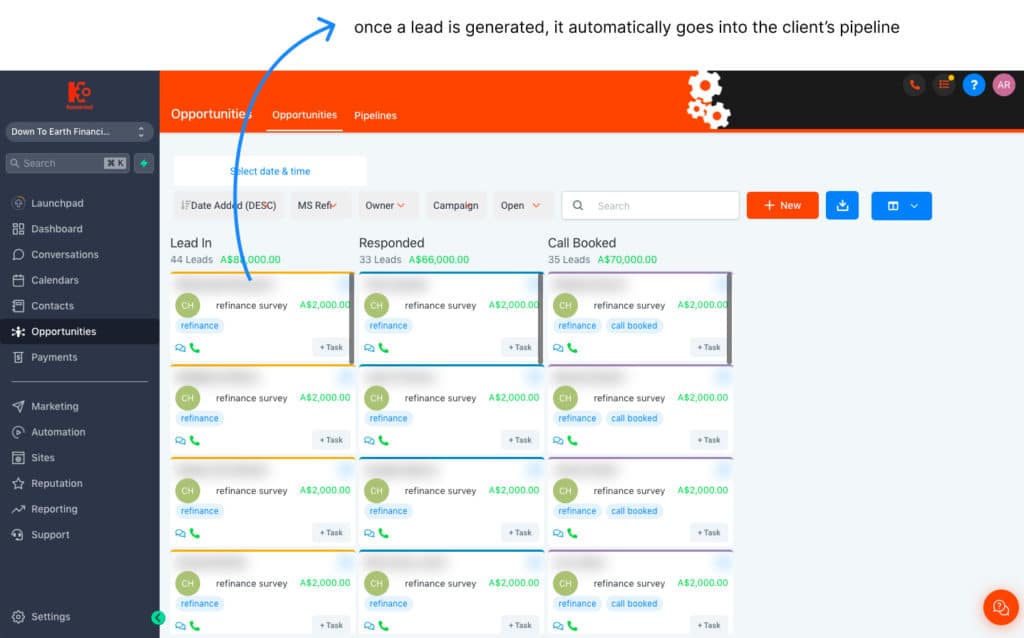

Once a lead clicks the ad and sends his information, it goes to the CRM, and everything is automated. Our team sets up all the workflows and automation to make lead management convenient for our mortgage brokers. All Colin needs to do is to convert his leads into loan applications. Our mortgage broker partners go through conversion training when starting with us to help them convert more leads.

Get Our Modern Broker Method System

A plug-and-play marketing package for mortgage brokers. These are proven and tested marketing methods that are specifically tailored to your services.

The Result

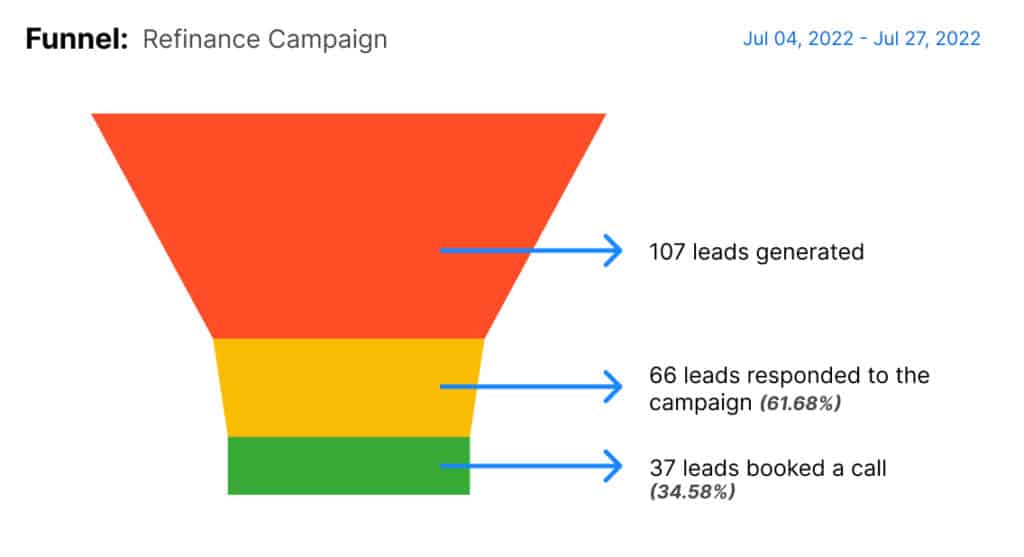

Our mortgage broker marketing system has generated 108 leads in one month for Down to Earth Finance. Out of those, 37 leads have booked a call, and 66 leads responded to the campaign.

From the 37 leads that booked a call, Colin was able to convert 13 leads into customers with a total loan volume of $5,828,000. Furthermore, there are still 6 more leads in the pipeline which will convert soon. This is valued at over $2 million in loan volume.

Note: There is so much money left behind this month. Colin knows this and only followed up with people who booked a call. There are around 60+ leads which are a mixture of hot and warm leads. (We will be following up on this data over the next week with our phone callers) We expect to book another bag of calls.

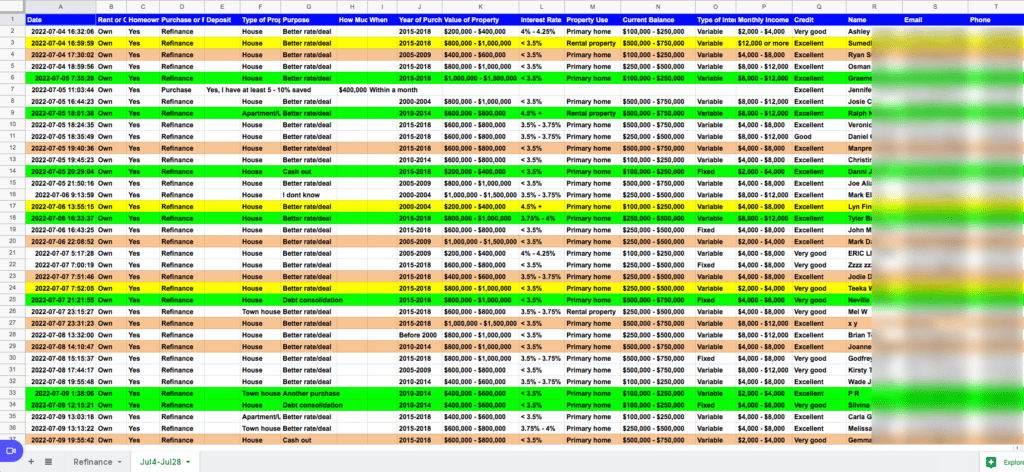

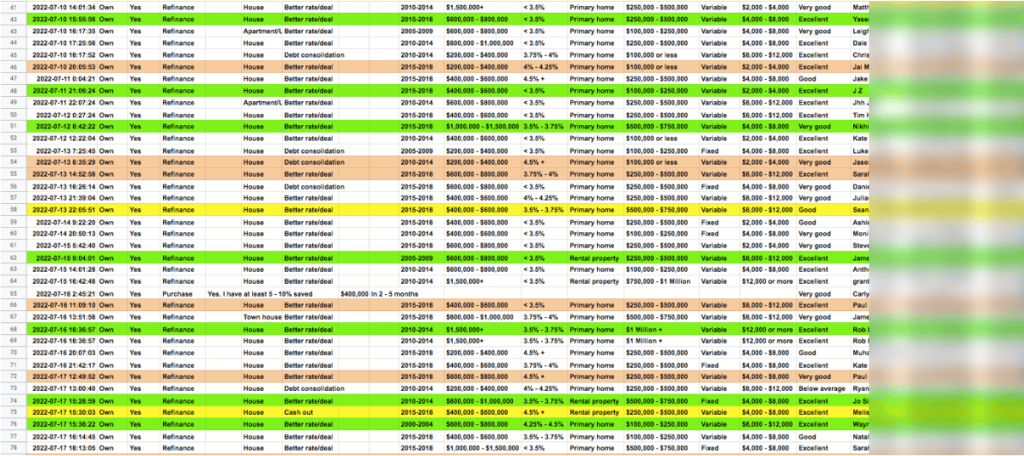

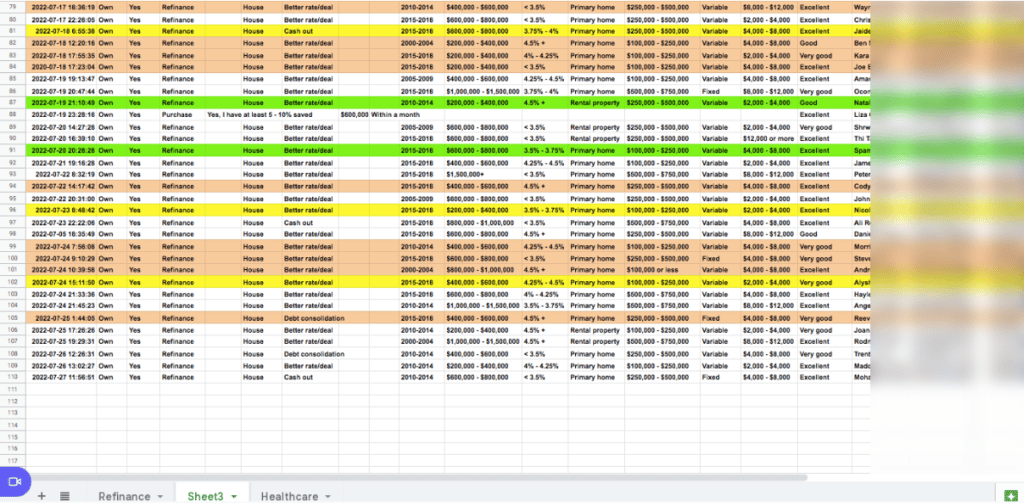

We also provide a Leads Master sheet report in a google sheet file for backup and internal use. This is what their pipeline looks like since we publish the ads 3.5 weeks later.

Period: Jul 4, 2022 to Jul 27, 2022

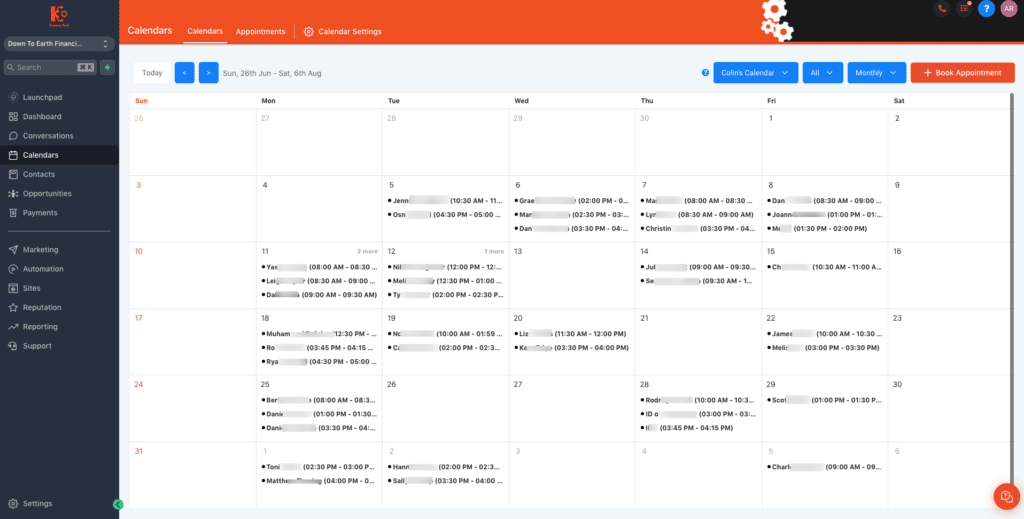

This is Colin's calendar for the month of July. Some days have more than 2 appointments, and even up to 5 appointments in one day.

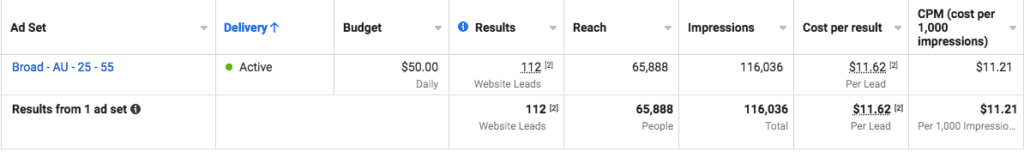

Facebook & Instagram Ads performance

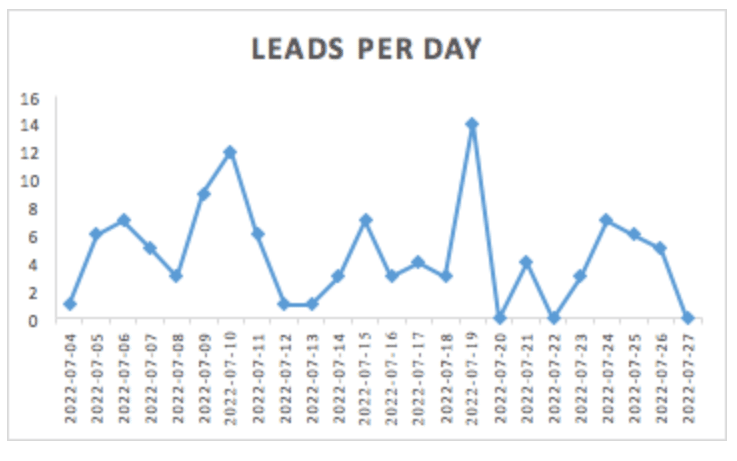

This is a snippet of Facebook and Instagram ads performance for the first month (July). We generated 114 leads with an average of 5 leads per day and an average cost of $11.13 per lead.

Average leads per day = 5

Average cost per lead = $11.13 AUD

The solution we offer, plus the Modern Broker Method system, has allowed Down to Earth Finance to get their business back on track. In one month, they submitted almost $6 million in loan applications and reached a 25X return on their investment.

More opportunities waiting

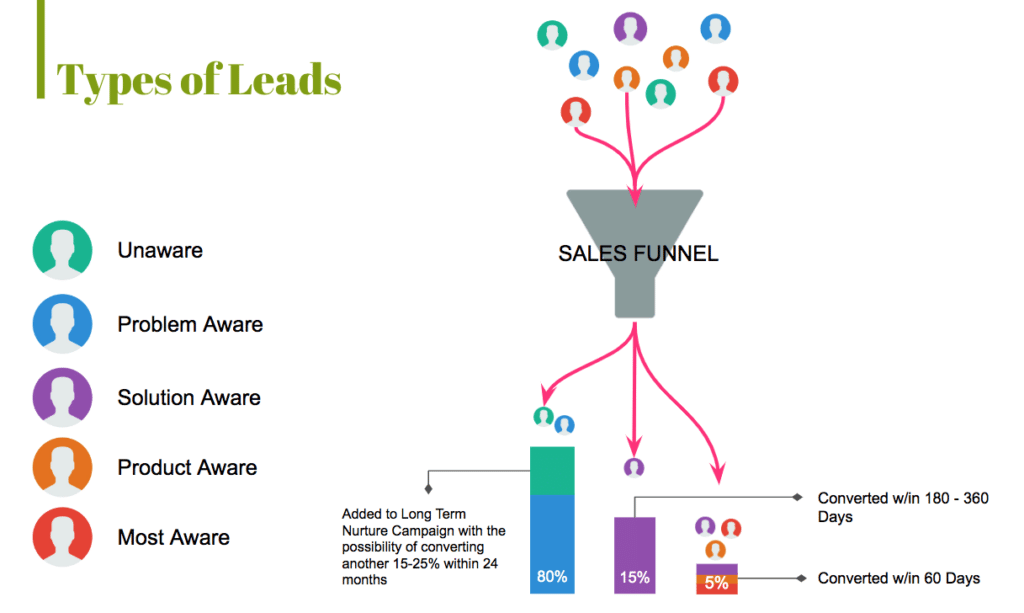

Colin's conversion rate from this result is around 12% on the total leads generated. But if we compare it to the leads that have only booked a call with Colin, his conversion rate, including the ones in the pipeline, would be over 50%.

As mentioned earlier, Colin still has 66 leads that have responded to the campaigns. These are warm leads that have taken an interest in knowing more about the service and it's benefits, but they haven't been qualified by the broker yet.

And the rest of the 47 leads come into the system but have not taken action; they haven't booked a call or even responded to the SMS campaigns. But with a reactivation campaign, there might be few leads there that are convertible. So the bottom line is, that there's an opportunity of over $10M loan volume from last month's leads.

The Real Challenge

The real challenge is not about generating leads. The Modern Broker Method system allows you to generate leads from social media marketing and book appointments for you - all done on autopilot. The real challenge for you is converting the leads from your system into loan applications.

This is where our agency sets us apart from other digital marketing agencies. At Konnect Marketing, we don't just provide the system to our clients. We create relationships with our clients to help and train them to convert their leads into customers.

If you're a mortgage broker looking for an innovative way to get more leads, contact us today. We can help you too!

Get Our Modern Broker Method System

A plug-and-play marketing package for mortgage brokers. These are proven and tested marketing methods that are specifically tailored to your services.